Uniform Residential Loan Application Form

What is your Ethnicity and Race? A Mortgage lender can ask that? Under the Uniform Residential Loan Application Form rules not only are bankers permitted to ask that question…they are required to ask that question. You can choose to check off a box saying “I do not wish to furnish this information.” If you do check this box the lender will then be required to note his visual observations. These observations will be combined with the probable origin of your surname to come up with their best guess.

The purpose of this policy is to prevent systematic discrimination. People who find this practice more than a little uncomfortable are to be forgiven. The practice still feels like what lawyers call a “double edged sword.” The question has the power to hurt or help in equal measure depending on its actual use. Mortgage application personal questions need to be understood in advance. Mortgage application personal questions can be shocking.

Married, Single or Separated?

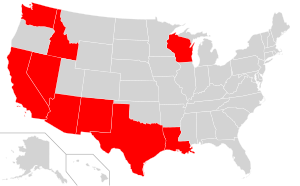

Here comes that intrusive banker putting his nose into my personal business with more mortgage application personal questions. Or is this question asked for good enough reason to be permissible? In community property states such as California the looming specter of a divorce changes everything. Your soon to be ex spouse’s debts could become your responsibility too. Title to Real Estate can become a tangled mess. In any state there may be the legal necessity of executing an “interspousal transfer deed” removing one party from the title to the property as well as responsibility for the mortgage. Although I have my reservations about the Racial question I’ll have to give the bankers my personal OK on this question. I’m sure my personal OK will come as a great relief to them.

Are you subject to a legal judgment or a party to a Lawsuit?

A legal judgment is as high a form of legal obligation as exists. No question that this is fair game. A pending lawsuit is a little more worrisome. Certainly being the losing party in a lawsuit could mean obligations will be imposed that will affect your ability to pay your mortgage. Most lawsuits are settled quietly. If the case goes to trial the rough statistics would show a 50-50 chance of you losing. Of course this is also a 50-50 chance of you winning. As with most rules the key to fairness is the way in which the rule is implemented. Hopefully most bankers are sensitive to the fact that it may only be fair to have their own lawyer take a hard look at the facts of the individual case. By this I mean to give a fair analysis of the real deal. What is the realistic probable result given the facts? What is the best that can happen and the worst that can happen? Garden variety law suits should really have little to no effect on your application. Frivolous claims are easy to file but hard to prove.

How Many Years have you been at your Job?

Stability is big in the eyes of bankers. Nothing represents stability to them like working for years in the same industry. Long years in the same job are great. What the lender is really even more interested in is years in the same profession or industry. The longer you stay in the same field the more stable you are in the banker’s eyes. Your income is likely to be higher too. Those who are new to a particular industry are considered to be more insecure with less income.

This does not mean you should hesitate to make a move if you think the move is right for you. A promotion or a new job can give a banker a good reason to ignore the general assumption that applicants with more years in the same industry are to be preferred. Mortgage application personal questions are the beginning not the end of the banker’s analysis.

A larger down payment will sweeten any banker’s perspective on the whole picture.